When comparing loan providers, it is important to carefully evaluate the pros and cons of each option. Modo Loan is a lending platform that connects borrowers to lenders, but how does it measure up to its competitors? In this section, we will provide an overview of Modo Loan and its competitors and stress the importance of considering the pros and cons before making a decision.

Overview of Modo Loan and its competitors

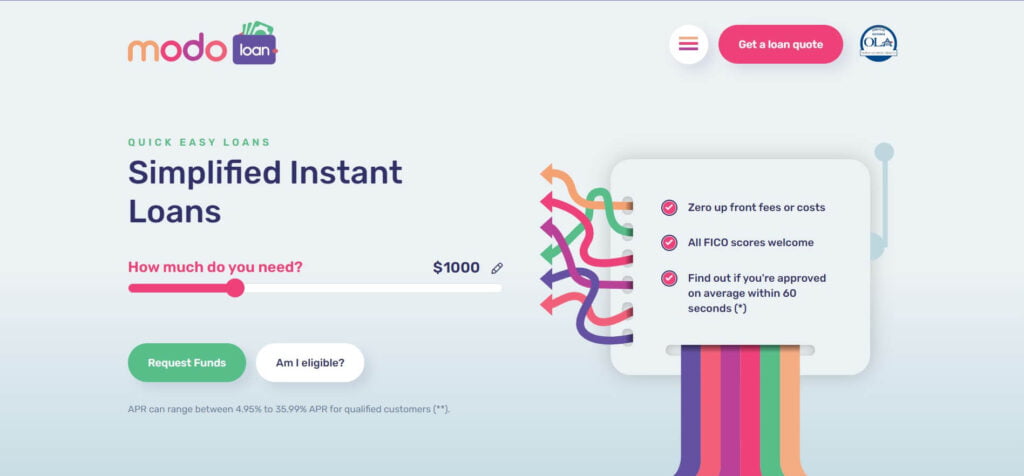

Modo Loan is primarily a loan introduction service that aims to connect borrowers to a network of lenders. It provides a convenient online platform for personal loan needs. However, it is essential to compare Modo Loan with its competitors to understand the advantages and disadvantages of each option.

Some of the top loan companies in the USA, such as LendingClub, SoFi, and Prosper, offer similar services. These competitors may have different loan products, fees, interest rates, and eligibility requirements. Examining customer reviews and feedback can provide insights into the experiences of real-life clients and help determine the legitimacy and reliability of each lender.

The importance of weighing pros and cons when choosing a loan provider

Choosing a loan provider is a significant financial decision, and it is crucial to consider the pros and cons before committing. Evaluating the different loan products, fees, interest rates, and eligibility requirements can help ensure that you find the best fit for your financial needs.

The pros and cons of each loan provider can vary depending on individual preferences and circumstances. Some borrowers may prioritize lower interest rates, while others may value a seamless borrowing experience. Taking the time to compare and analyze the pros and cons of Modo Loan and its competitors can lead to a more informed decision and ultimately help you choose the lender that best meets your needs. [1][2][3][4]

Modo Loan Pros

Free applications and no upfront fees

One of the advantages of Modo Loan compared to its competitors is that it offers free applications with no upfront fees. This means that borrowers can explore their loan options without incurring any financial commitment at the initial stage. By eliminating these costs, Modo Loan makes the loan application process more accessible and user-friendly for borrowers.

Working with multiple lenders to offer a wide range of APR rates

Modo Loan stands out from its competitors by working with multiple lenders, which allows them to offer a wider range of APR rates. This gives borrowers the opportunity to find loan options that best fit their financial situation and goals. Having access to a variety of APR rates gives borrowers more flexibility and increases their chances of finding a loan with favorable terms.

While Modo Loan has its advantages, it’s important to also consider the potential cons before making a decision. These include limited loan options and less direct control over loan terms. Compared to some lending platforms that offer a wide range of loan products, Modo Loan specializes in connecting borrowers with lenders but does not directly provide loan options. This means you may have a more limited selection of loan products to choose from. Additionally, as Modo Loan acts as an intermediary between borrowers and lenders, you have less direct control over the loan terms offered. [5][6][7][8]

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

Modo Loan Cons

Short loan repayment periods starting from 61 days onwards

One potential drawback of Modo Loan is that the loan repayment periods are relatively short, starting from 61 days onwards. This means that borrowers may need to make larger monthly payments to ensure they can repay the loan within the specified time frame. It’s important for borrowers to carefully consider their financial situation and ensure they can comfortably meet these repayment obligations before committing to a loan with Modo.

The need for careful consideration when choosing a loan with bad credit

While Modo Loan does offer decent approval odds for individuals with less-than-perfect credit, it’s crucial for borrowers to exercise caution when choosing a loan. It’s important to carefully review the terms and conditions, including the interest rate and any associated fees, to ensure that the loan is manageable and aligns with their financial goals. Borrowers with bad credit may also want to consider alternative options or speak with a financial advisor to explore all possible avenues before committing to a loan with Modo.

Comparatively, Modo Loan stands out from its competitors with its fast funding, competitive rates, soft credit check, clear terms, and easy application process. However, borrowers should carefully consider the loan repayment periods and assess their own financial situation when deciding if Modo Loan is the right choice for their needs. [9][10][11][12]

Competitor Comparison

Comparison between Modo Loan and alternative loan providers

When comparing Modo Loan to other popular online lenders like LendingClub, Upstart, and Payoff, there are several key factors to consider.

Modo Loan offers fast funding, competitive rates, a soft credit check, clear terms, and an easy application process. These features make it stand out from its competitors and are attractive to borrowers seeking quick and hassle-free access to funds.

On the other hand, Modo Loan’s short loan repayment periods, starting from 61 days onwards, may be a drawback for some borrowers. This means larger monthly payments and the need for careful financial planning to ensure timely loan repayment.

In contrast, alternative lenders like LendingClub, Upstart, and Payoff may offer longer repayment terms, possibly making monthly payments more manageable for borrowers. However, these lenders may have stricter documentation requirements, longer waiting periods for approval, and slower funding times compared to Modo Loan.

It is important for borrowers to carefully consider their individual financial situations and priorities when choosing a loan provider. While Modo Loan may be a good fit for those seeking quick funding and competitive rates, other lenders may be more suitable for borrowers who prioritize longer repayment terms or have specific documentation needs. [13][14][15][16]

Conclusion

When it comes to choosing a loan provider, it is crucial to make an informed decision based on your individual financial situation and priorities. Modo Loan stands out from its competitors with its fast funding, competitive rates, soft credit check, clear terms, and easy application process. These features make it a great option for borrowers who value quick and hassle-free access to funds.

However, Modo Loan’s short loan repayment periods starting from 61 days onwards may be a drawback for some borrowers. This means larger monthly payments and the need for careful financial planning to ensure timely loan repayment. On the other hand, alternative lenders like LendingClub, Upstart, and Payoff may offer longer repayment terms, making monthly payments more manageable for some borrowers.

Ultimately, the choice between Modo Loan and its competitors depends on your specific needs and preferences. If you prioritize quick funding and competitive rates, Modo Loan could be the right choice for you. However, if longer repayment terms or specific documentation requirements are more important to you, it may be worth considering alternative lenders.

In conclusion, Modo Loan represents a unique approach to the world of borrowing and lending with both its advantages and limitations. As a trusted intermediary, Modo Loan simplifies the loan application process, offering a range of benefits such as no fees, a swift online application, and a commitment to transparency. While Modo Loan may be a good fit for those seeking quick funding and competitive rates, it is important to carefully consider your individual needs and compare it to alternative lenders before making a decision. [17][18][19][20]

seeesan is a passionate finance writer who specializes in creating in-depth reviews, comparisons, and guides focused on loans, credit cards, banks, and other financial products.

With over 7 years experience analyzing the fine print and key details that matter most to consumers, seeesan founded Loans Reviewer as the premier destination for straightforward analysis on all things loans and lending. Site also covers adjacent personal finance topics that equip readers to maximize savings and make smarter borrowing choices.

Drawing on a background in financial risk analysis and consumer research, seeesan takes pride in demystifying complex money matters through educational, easy to digest writing. Strongly believes financial literacy and transparency drive better decision making.