What is APR and How Does it Work?

Understanding APR and its significance

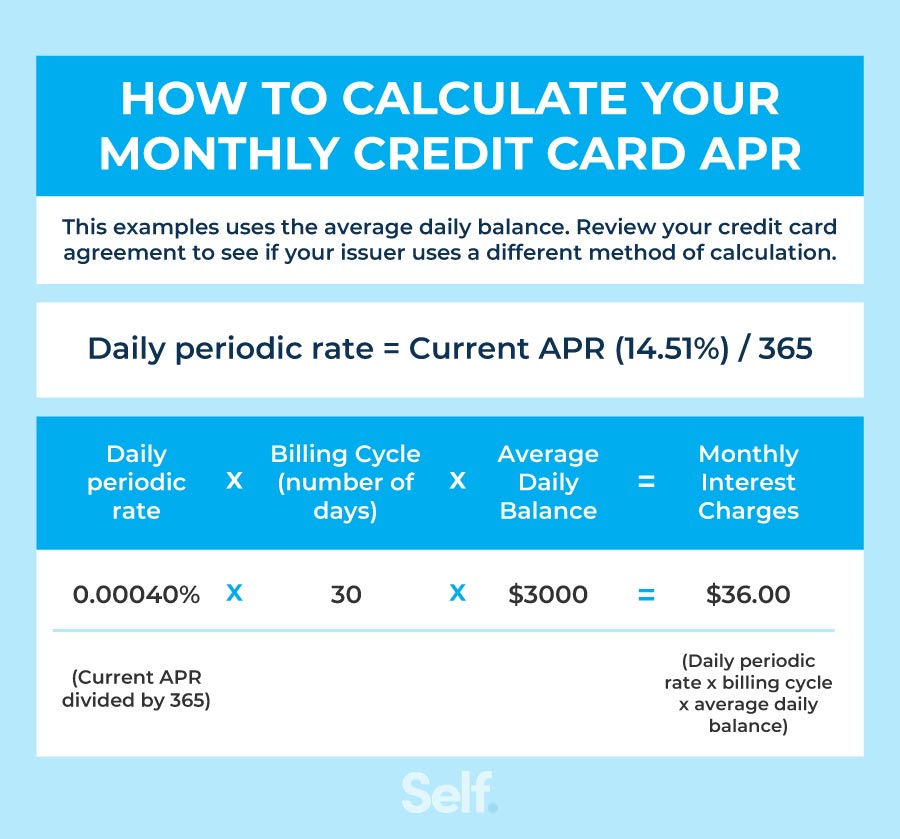

APR, or Annual Percentage Rate, is a term you often hear when applying for a loan or credit card. It is a crucial factor to consider as it determines the overall cost of borrowing. Essentially, APR represents the yearly interest rate and any additional fees associated with the loan. By understanding APR, you gain insight into the true cost of borrowing and can make informed decisions about your finances. Comparing APRs allows you to find the most affordable loan option and avoid falling into a debt trap.

Factors that affect APR rates

Several factors influence APR rates, including your credit score, the type of loan or credit card, and the current market conditions. Lenders use your credit score to assess your creditworthiness and determine the risk level of lending to you. A higher credit score typically results in lower APR rates. Additionally, the type of loan or credit card can impact the APR. For example, mortgages often have lower APR rates compared to credit cards. Finally, market conditions, such as interest rate fluctuations, can also affect APR rates. It is essential to stay updated on these factors to make the best financial decisions.

Introduction to Modo Loans

What are Modo Loans?

Modo Loans is a reputable lending company that offers customers a range of loan options to meet their financial needs. Whether you require funds for a home renovation, educational expenses, or a vacation, Modo Loans provides a hassle-free borrowing experience. With competitive interest rates and flexible repayment terms, Modo Loans strives to make borrowing accessible and affordable for individuals of all credit profiles.

Benefits of Modo Loans

When considering APR rates for Modo Loans, there are several key benefits to take into account. Firstly, Modo Loans takes your credit score into consideration when determining your APR rate. This means that if you have a higher credit score, you may be eligible for lower interest rates, potentially saving you money over the life of the loan. Additionally, Modo Loans offers personalized customer service and a straightforward application process. This ensures that you can navigate the borrowing process with ease and confidence. By choosing Modo Loans, you can access the funds you need while enjoying competitive APR rates and excellent customer support.

APR Rates for Modo Loans

Overview of APR rates for Modo Loans

Modo Loans prides itself on offering competitive APR rates to its customers. The APR, or Annual Percentage Rate, is the total cost of borrowing including both the interest rate and any additional fees or charges. With Modo Loans, you can expect APR rates that are affordable and tailored to your credit profile. By considering factors such as your credit score, Modo Loans aims to provide lower interest rates for individuals with higher credit scores. This means that if you have a good credit history, you have the opportunity to save money over the life of the loan with a lower APR rate.

Factors influencing APR rates for Modo Loans

Modo Loans takes various factors into account when determining APR rates for customers. Your credit score plays a significant role in influencing the rate you are offered. A higher credit score indicates a lower risk for the lender, resulting in a potentially lower APR rate. Other factors, such as the loan amount and repayment term, may also impact the APR rate. Modo Loans aims to provide personalized and competitive rates to ensure that borrowers can access the funds they need while enjoying affordable terms and favorable interest rates.

Comparing APR Rates for Modo Loans

Comparison of APR rates among different lenders

When it comes to borrowing money, it is essential to compare the APR rates offered by different lenders. While Modo Loans prides itself on providing competitive rates, it is crucial to explore other options as well. By comparing APR rates among lenders, you can ensure that you are getting the best deal possible. Take into account the interest rate, any additional fees or charges, and the repayment term when comparing APR rates. This will allow you to make an informed decision and choose the lender that offers the most favorable terms for your financial needs.

Tips for finding the best APR rates for Modo Loans

To find the best APR rates for Modo Loans, there are a few tips you can follow. First, make sure to check your credit score as it plays a significant role in determining the rate you will be offered. Improving your credit score can help you secure a lower APR rate. Additionally, it is important to shop around and compare rates from multiple lenders. This will give you a better understanding of the current market rates and enable you to negotiate for the best rate possible. Finally, consider the loan amount and repayment term that suits your financial situation and goals.

Conclusion

When it comes to borrowing money, comparing APR rates among different lenders is crucial. While Modo Loans offers competitive rates, it is essential to explore other options as well. By considering the interest rate, additional fees or charges, and repayment term, you can make an informed decision and choose the lender that provides the best terms for your financial needs. To find the best APR rates for Modo Loans, check your credit score, shop around and compare rates from multiple lenders, and consider the loan amount and repayment term that suits your financial situation. By following these tips, you can secure the most favorable APR rate and save money in the long run.

Final thoughts on APR rates for Modo Loans

Comparing APR rates is an essential step in securing the best loan deal for your financial needs. Modo Loans prides itself on offering competitive rates, but it is always wise to explore other lenders and compare their rates. Remember to consider the overall cost of the loan, including additional fees and charges, and the repayment term. By doing thorough research and considering various factors, you can ensure that you make an informed decision and choose the loan option with the most favorable APR rate for your situation.

seeesan is a passionate finance writer who specializes in creating in-depth reviews, comparisons, and guides focused on loans, credit cards, banks, and other financial products.

With over 7 years experience analyzing the fine print and key details that matter most to consumers, seeesan founded Loans Reviewer as the premier destination for straightforward analysis on all things loans and lending. Site also covers adjacent personal finance topics that equip readers to maximize savings and make smarter borrowing choices.

Drawing on a background in financial risk analysis and consumer research, seeesan takes pride in demystifying complex money matters through educational, easy to digest writing. Strongly believes financial literacy and transparency drive better decision making.