Overview of Modo and its features

Modo is a leading financial platform that specializes in providing personal loans to individuals. With its user-friendly interface and seamless online application process, Modo has quickly become a popular choice for those in need of quick and convenient financing.

One of the key features of Modo is its competitive interest rates, which make it an attractive option for borrowers looking to minimize the cost of their loans. Additionally, Modo offers flexible repayment terms, allowing borrowers to customize their repayment schedule to fit their financial situation.

Understanding personal loans and their importance

Personal loans are a type of unsecured loan that can be used for various purposes, such as consolidating debt, financing a home renovation, or covering unexpected expenses. Unlike other types of loans, personal loans do not require collateral, making them accessible to a wide range of individuals.

The importance of personal loans lies in their ability to provide financial support when needed most. Whether you are facing an emergency expense or looking to fund a major purchase, a personal loan can bridge the gap and provide the necessary funds.

In conclusion, Modo offers a convenient platform for obtaining personal loans, with competitive rates and flexible repayment options. Personal loans, in general, play a crucial role in providing financial assistance to individuals in times of need.

LendingClub

If you are looking for an alternative to Modo for personal loans, one reputable option is LendingClub. LendingClub is a well-established financial platform that offers a variety of loan options tailored to meet your needs.

With LendingClub, you can expect competitive interest rates that can help minimize the cost of your loan. Additionally, LendingClub provides flexible repayment terms, allowing you to customize your repayment schedule to fit your financial situation.

Whether you need funds for debt consolidation, home renovation, or any other purpose, LendingClub can be a reliable choice. Their platform is user-friendly and their online application process is seamless, making it convenient to obtain a personal loan.

In summary, LendingClub is a reputable alternative to Modo for personal loans. Their loan options, competitive interest rates, and flexible repayment terms make them a reliable choice for individuals seeking financial assistance.

Prosper

Looking for another reliable alternative to Modo? Consider Prosper, a well-known online lending platform. Prosper offers a range of personal loan options to suit your needs. With competitive interest rates and flexible repayment terms, Prosper can provide the financial assistance you’re seeking.

Applying for a loan with Prosper is a straightforward process. Their online application is user-friendly and can be completed in just a few minutes. Once your application is submitted, Prosper quickly reviews it to determine your eligibility. If approved, you can expect to receive your funds within a few business days.

If you’re in need of a personal loan and want a reliable alternative to Modo, Prosper is worth considering. Their transparent and convenient loan application process, along with their competitive rates, make them a popular choice for borrowers.

Upstart

Upstart: An Innovative Approach to Personal Loans

Looking for a reliable alternative to Modo for your personal loan needs? Consider Upstart, an online lending platform that takes a fresh and innovative approach to the lending process.

Upstart stands out from traditional lenders by utilizing advanced technology and data-driven algorithms to assess borrowers’ creditworthiness. Instead of solely relying on credit scores, Upstart considers other factors such as education, job history, and potential earning power. This unique approach allows them to offer loans to individuals who may not qualify through traditional channels.

Applying for a personal loan through Upstart is a straightforward process. Their user-friendly online application can be completed within minutes. Once submitted, Upstart quickly reviews your application and provides loan offers tailored to your specific financial needs.

With competitive interest rates and flexible repayment terms, Upstart offers a reliable alternative to Modo for borrowers who are looking for a more inclusive and innovative lending experience.

Innovative Lending Platforms

In addition to Upstart, other innovative lending platforms like Prosper and LendingClub are worth considering. These platforms provide competitive personal loan options with transparent application processes and quick funding. Prosper offers a diverse range of loan options and flexible repayment terms, while LendingClub connects borrowers with individual investors for potential lower interest rates.

When searching for alternatives to Modo, exploring these innovative lending platforms can help you find the best match for your personal loan needs.

SoFi

Online lending platform for personal loans

When looking for an alternative to Modo for personal loans, one platform that stands out is SoFi. SoFi is an online lending platform that offers a wide range of personal loan options to meet your financial needs. Whether you’re looking to consolidate debt, pay for a home renovation, or fund a major purchase, SoFi has you covered.

SoFi’s member benefits and competitive interest rates

SoFi not only provides competitive interest rates but also offers various member benefits that make it an attractive option for borrowers. As a SoFi member, you can access career coaching, financial planning services, member events, and networking opportunities. These perks set SoFi apart from traditional lenders and provide added value to its borrowers.

With its user-friendly online application process and quick funding, SoFi is a reliable alternative to Modo for borrowers looking for a seamless and inclusive lending experience. Consider SoFi for your personal loan needs and take advantage of its competitive rates and member benefits.

Avant

Looking for a reliable alternative to Modo for personal loans? Consider Avant. Avant is an online lending platform that offers a secure and convenient way to borrow money.

Secure and Convenient Lending Platform

Avant provides a simple and user-friendly online application process, allowing borrowers to apply for personal loans from the comfort of their own homes. The platform utilizes advanced security measures to protect sensitive information, giving borrowers peace of mind.

Avant’s Flexible Repayment Options and Customer Support

One of the key advantages of Avant is its flexible repayment options. Borrowers can choose repayment terms that suit their financial situation, helping them manage their loan responsibly. Additionally, Avant offers excellent customer support, with a dedicated team ready to assist borrowers with any questions or concerns they may have.

Consider Avant as a trustworthy alternative to Modo for your personal loan needs. With its secure platform, flexible repayment options, and reliable customer support, Avant is a great choice for borrowers seeking a hassle-free borrowing experience.

Peerform

Peerform

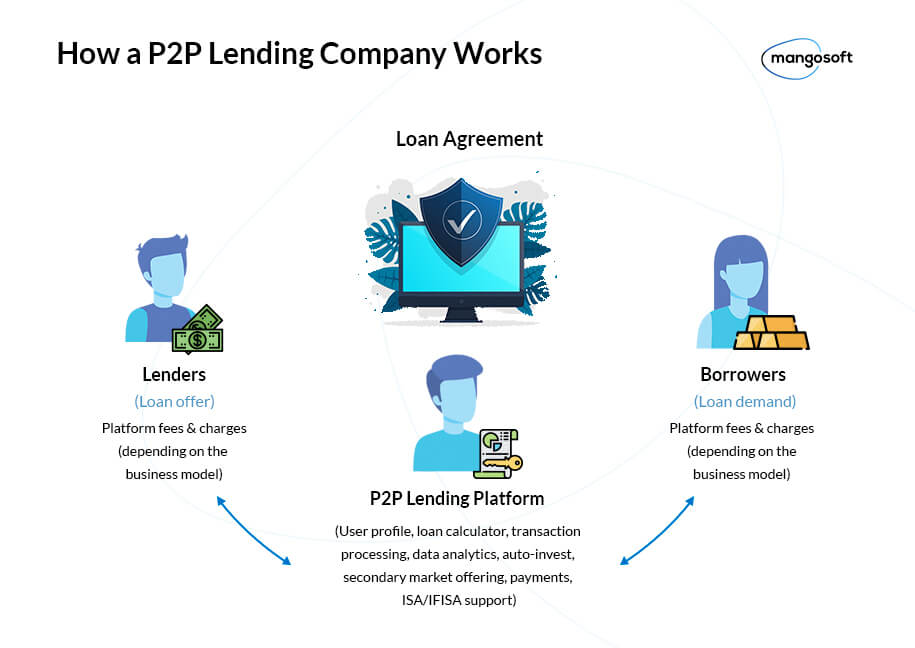

Peerform is a peer-to-peer lending platform that provides an alternative option for personal loans. Unlike traditional lenders, Peerform connects borrowers directly with individual investors, cutting out the middleman and potentially offering more competitive interest rates and flexible terms.

Understanding how Peerform works and its advantages

Peerform works by creating a marketplace where borrowers can request a loan and investors can choose to fund the loan based on their own criteria. The platform utilizes advanced technology and data analysis to assess borrowers’ creditworthiness and assign them a risk grade, which helps investors make informed lending decisions.

One of the advantages of choosing Peerform is the potential for lower interest rates compared to traditional lenders. Additionally, Peerform offers flexible repayment options, allowing borrowers to select a repayment plan that aligns with their financial situation.

Peerform also provides excellent customer support, with a friendly and knowledgeable team ready to assist borrowers throughout the loan application process.

Consider Peerform as a viable alternative to Modo for your personal loan needs. With its peer-to-peer lending model, competitive interest rates, flexible repayment options, and reliable customer support, Peerform offers a convenient and hassle-free borrowing experience.

Comparing LendingClub, Prosper, Upstart, SoFi, Avant, and Peerform

When it comes to alternatives to Modo for personal loans, there are several reputable options available. LendingClub, Prosper, Upstart, SoFi, Avant, and Peerform are among the top choices. Each platform offers unique advantages and features that cater to different borrower needs.

LendingClub and Prosper are well-established peer-to-peer lending platforms that connect borrowers with investors. They provide competitive interest rates and flexible repayment options. Upstart utilizes innovative technology to assess borrowers’ creditworthiness, often providing loans to individuals with limited credit history. SoFi stands out for its comprehensive financial services and benefits, including career support and networking opportunities. Avant focuses on providing personal loans to individuals with average credit scores and offers quick funding options. Finally, Peerform, as mentioned earlier, offers lower interest rates compared to traditional lenders and excellent customer support.

Ultimately, the best alternative to Modo for personal loans depends on your specific needs and preferences. It is essential to thoroughly research and compare these platforms to find the one that aligns with your goals and financial situation.

Frequently Asked Questions

1.What factors should I consider when choosing an alternative to Modo for personal loans?

When selecting an alternative lender, consider factors such as interest rates, loan terms, fees, borrower requirements, customer support, and reputation. It’s important to choose a lender that offers terms and conditions that suit your needs and financial situation.

2.What is the application process like for alternative lenders?

The application process for alternative lenders typically involves filling out an online application, providing necessary documentation, and undergoing a credit check. Some lenders may require additional information or documentation depending on their specific requirements.

3.Can alternative lenders offer better rates than traditional banks?

Yes, alternative lenders often provide competitive interest rates compared to traditional banks. Their streamlined operations and innovative lending models allow them to offer more favorable terms to borrowers.

4.Are alternative lenders trustworthy?

Most alternative lenders are reputable and trustworthy. However, it is crucial to research and choose lenders with a proven track record, positive customer reviews, and transparent lending practices.

5.How long does it take to receive funds from alternative lenders?

The speed of funding varies depending on the lender and the borrower’s application. Some lenders offer quick funding options, providing funds within a few business days, while others may take longer to process and approve loans.

Overall, exploring alternatives to Modo for personal loans opens up a range of options that can offer better rates, flexible terms, and excellent customer support. Careful consideration and comparison will help you find the lender that meets your needs and provides a convenient borrowing experience.

seeesan is a passionate finance writer who specializes in creating in-depth reviews, comparisons, and guides focused on loans, credit cards, banks, and other financial products.

With over 7 years experience analyzing the fine print and key details that matter most to consumers, seeesan founded Loans Reviewer as the premier destination for straightforward analysis on all things loans and lending. Site also covers adjacent personal finance topics that equip readers to maximize savings and make smarter borrowing choices.

Drawing on a background in financial risk analysis and consumer research, seeesan takes pride in demystifying complex money matters through educational, easy to digest writing. Strongly believes financial literacy and transparency drive better decision making.