Navigating the seas of lending and borrowing can be daunting, especially when there are numerous companies to choose from. One such company that you might have come across is Modo Loan BBB.

Overview of Modo Loan BBB and its Legitimacy

Modo Loan BBB, officially known as Modoc Tribe Financial Services Authority doing business as 500FastCash, operates within the Better Business Bureau’s (BBB) parameters. It’s registered with the BBB, enhancing its reliability as a lender. Borrowers can trust that the company complies with the regulatory standards set by BBB in business ethics, resolving disputes, and overall customer service, making it a legitimate option for those seeking short-term loan options. [1][2]

Modo Loan Accreditation

In the realm of financial services, accreditation aids in building trust and offering customers a sense of security. Modo Loan BBB, being a BBB accredited business, has committed to uphold Better Business Bureau accreditation standards which include a pledge to resolve consumer complaints and embody trustworthy and ethical business practices.

Modo Loan’s BBB Rating and Adherence to Accreditation Standards

The BBB rating of Modo Loan underscores the company’s compliance with accreditation standards. It’s a testament to the company’s dedicated commitment to offering transparent and reliable services, resolving any customer complaints promptly, and maintaining a strong adherence to ethical business practices. The rating contributes to enhancing the credibility and trustworthiness of Modo Loan among its consumers.

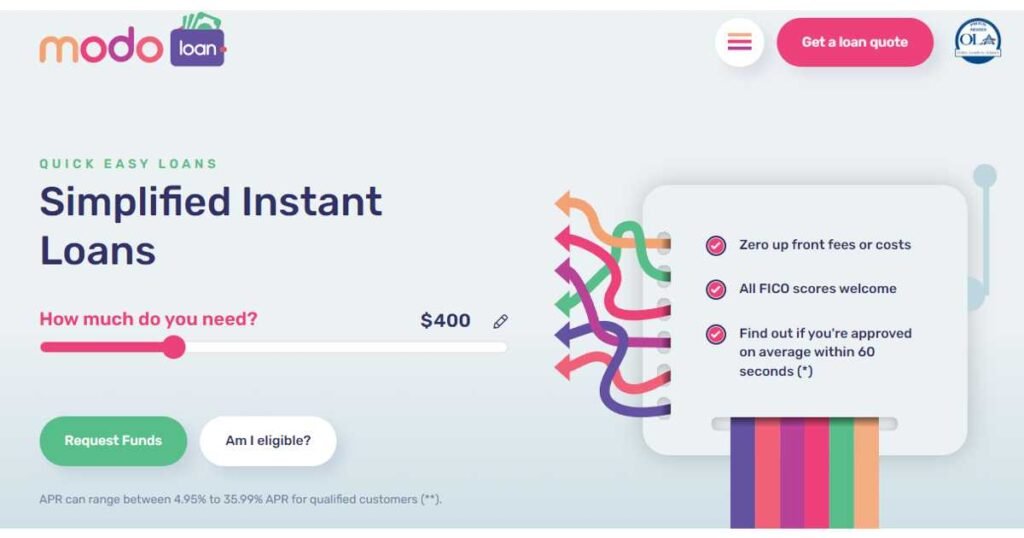

Offering user-centric financial services, Modo Loan has made a significant mark in the industry. Understanding that every borrower’s need is unique, Modo Loan extends a range of low Annual Percentage Rate (APR) options, providing affordable solutions to its customers.

Low APR rates and repayment terms offered by Modo Loan

Modo Loan impressively balances their consumer-friendly low APR rates with flexible repayment terms. This feature not only enhances the borrowing experience but also empowers customers with financial resilience, making repayment manageable and less burdensome. Indeed, Modo Loan’s commitment to ethical, transparent business practices have always been its strength, duly reflected in their BBB accreditation and rating. This strong commitment reassures customers of secure, reliable financial dealings with Modo Loan. [5][6]

Safety and Privacy Measures

Modo Loan’s commitment to safety and privacy speaks volumes about its ethical business practices. A vital part of this commitment includes safeguarding customers from scams.

Modo Loan’s Commitment to Customer Safety and Avoiding Scams

Modo Loan’s BBB accreditation signals its trustworthiness and dedication to fair and transparent dealings. To alleviate concerns about scams, this financial institution vigilantly monitors transactions and uses advanced security measures to protect customers’ personal information. Their commitment to avoiding scams reinforces Modo Loan’s regulation-abiding nature and devotion to a safe, scam-free environment for customers. [7][8]

Warning Signs of Scams

In the digital age, scams have become increasingly sophisticated. It’s crucial to know the signs that may indicate a potential scam to protect oneself. Modo Loan encourages customers to remain vigilant and recognize these warning signs.

Indications that a Loan Request May Be a Scam

A loan request might be a scam if an upfront payment is demanded, bogus fees are attached, or if promises of guaranteed approval are given without a credit check. Modo Loan, a BBB accredited business, strongly advises against engaging in such suspicious activities. [9][10]

Conclusion

Highlighting the Importance of Being Cautious and Informed When Dealing with Loans

In closing, it is imperative to leave no stone unturned when dealing with loans to avoid falling prey to scams. Modo Loan, a trusted financial institution accredited by the Better Business Bureau (BBB), remains a testament to legitimate financial services, enforcing comprehensive guidelines to guard against fraudulent practices. They advocate for an informed customer base and openly share valuable tips to help you navigate and make safe financial transactions. Hence, being informed and cautious is your first line of defense.

seeesan is a passionate finance writer who specializes in creating in-depth reviews, comparisons, and guides focused on loans, credit cards, banks, and other financial products.

With over 7 years experience analyzing the fine print and key details that matter most to consumers, seeesan founded Loans Reviewer as the premier destination for straightforward analysis on all things loans and lending. Site also covers adjacent personal finance topics that equip readers to maximize savings and make smarter borrowing choices.

Drawing on a background in financial risk analysis and consumer research, seeesan takes pride in demystifying complex money matters through educational, easy to digest writing. Strongly believes financial literacy and transparency drive better decision making.