Hopping onto the financial landscape, one can’t help but notice the Atlas Credit Card. But is it legit?

What is Atlas Credit Card?

The Atlas Credit Card, unlike traditional credit cards, is a card service geared towards assisting individuals build their credit score.

Is Atlas Credit Card Legit and trustworthy?

Indeed, the Atlas Credit Card is not only a legitimate business but also trustworthy. As well-known in the credit industry, Atlas Credit Card focusses on helping consumers improve their financial health, providing a viable pathway to credit score enhancement. Nonetheless, as with any financial decision, budding users should consider their individual needs and conduct thorough research

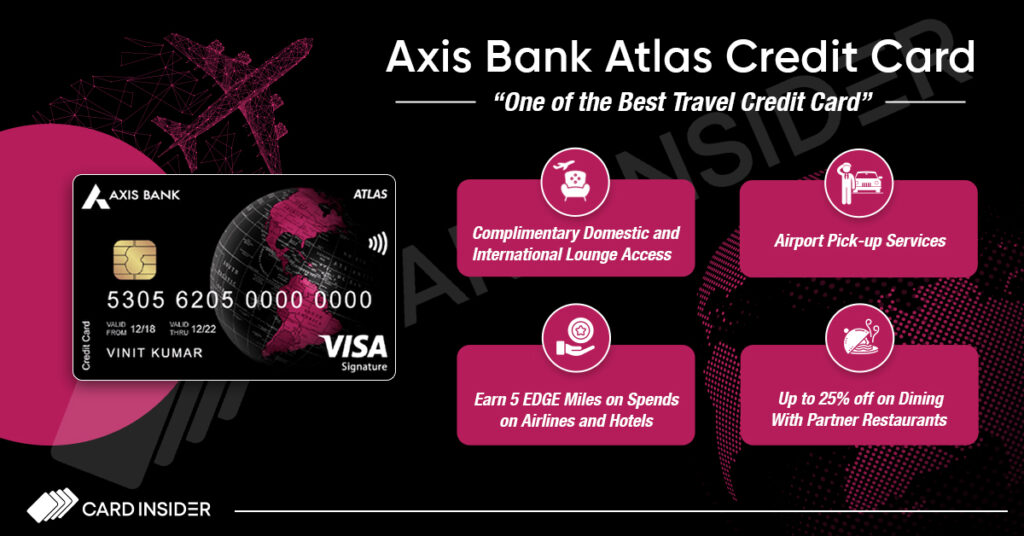

Atlas Credit Card Features and Benefits

Beyond being a legitimate tool for building credit scores, the Atlas Credit Card comes packed with several other features and benefits. Its primary focus remains helping users manage their credits better, but let’s delve into the extra perks it offers.

Atlas Credit Card Rewards and Cashback Options

Notably, the Atlas Credit Card offers a rewarding cashback scheme. Its users enjoy a cashback percentage on their purchases, a seemingly modest yet potentially significant way of saving and earning concurrently. This reward system encourages responsible spending and consistency in credit repayment.

Atlas Credit Card Fees and Interest Rates

Another remarkable feature of the Atlas Credit Card revolves around its fees and interest rates. Atlas takes pride in offering competitive and fair rates, ensuring users aren’t overwhelmed by high costs. Moreover, it practices transparent fee structures to avoid hidden charges, ensuring each customer understands what they’re

How to Apply for an Atlas Credit Card

Applying for an Atlas Credit Card is a fairly straightforward process. However, before you go about filling in your details, it’s crucial to understand the card’s eligibility requirements.

Atlas Credit Card Eligibility requirements

The Atlas Credit Card is open to applicants who meet the minimum age requirement and have an established credit history with a good credit score. Basic identification documentation and proof of steady income are also necessitated to be eligible.

Atlas Credit Card Application process

Once you confirm your eligibility, the process of applying for an Atlas Credit Card involves filling out an online application form with your personal and financial details. The bank reviews your application and, upon successful verification, approves your request, and your card is dispatched. Painless and swift, the Atlas Credit Card application process attests to its legitimacy, cementing its place as a competitive player in the financial space.

Atlas Credit Card Customer Reviews and Ratings

To discern whether the Atlas Credit Card is legitimate, one needs to analyze customer reviews and ratings. User feedback provides valuable insights into the effectiveness, reliability, and trustworthiness of a finance product.

Positive customer reviews and testimonials

Numerous customers commend Atlas Credit Card for its uncomplicated application process, swift approval and excellent after sales service. According to reviews, the card offers a range of valuable features that cater comprehensively to their financial needs.

Negative customer reviews and complaints

However, like any other product, the Atlas Credit Card has received a couple of negative reviews too. Some users have highlighted issues such as hidden charges, decreased credit limit without prior notification and slow customer service responses. It’s imperative to weigh these reviews and

Blog Section:

Conclusion

Is Atlas Credit Card Legit? Final thoughts and recommendations

Conclusively, the Atlas Credit Card can be considered a legitimate financial product, boasting a straightforward application process and a host of valuable features. However, the mix of positive and negative reviews underscore the importance of scrutinizing its policies concerning hidden charges and credit limit amendments. Therefore, potential cardholders should understand their financial requirements, conduct thorough research and seek expert advice before initiating the card application process.

Frequently Asked Questions

In the upcoming section, we will respond to some frequent inquiries to provide further insight and clarity about the Atlas Credit Card service. Understanding these could play a crucial role in your decision-making process.

seeesan is a passionate finance writer who specializes in creating in-depth reviews, comparisons, and guides focused on loans, credit cards, banks, and other financial products.

With over 7 years experience analyzing the fine print and key details that matter most to consumers, seeesan founded Loans Reviewer as the premier destination for straightforward analysis on all things loans and lending. Site also covers adjacent personal finance topics that equip readers to maximize savings and make smarter borrowing choices.

Drawing on a background in financial risk analysis and consumer research, seeesan takes pride in demystifying complex money matters through educational, easy to digest writing. Strongly believes financial literacy and transparency drive better decision making.